Irs Schedule F 2025 - Schedule F Balance Sheet IRS Form 5471 YouTube, The seven federal income tax brackets for 2025 and 2025 are 10%, 12%, 22%, 24%, 32%, 35% and 37%. Fillable Form 1040 (Schedule F), sign form online PDFliner, Your farming activity may subject you to state and.

Schedule F Balance Sheet IRS Form 5471 YouTube, The seven federal income tax brackets for 2025 and 2025 are 10%, 12%, 22%, 24%, 32%, 35% and 37%.

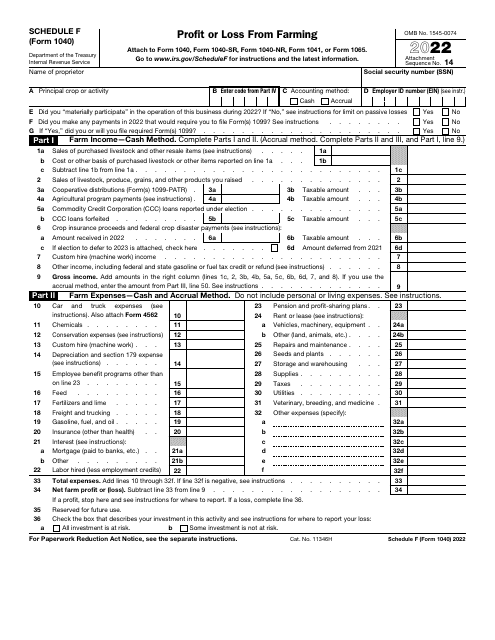

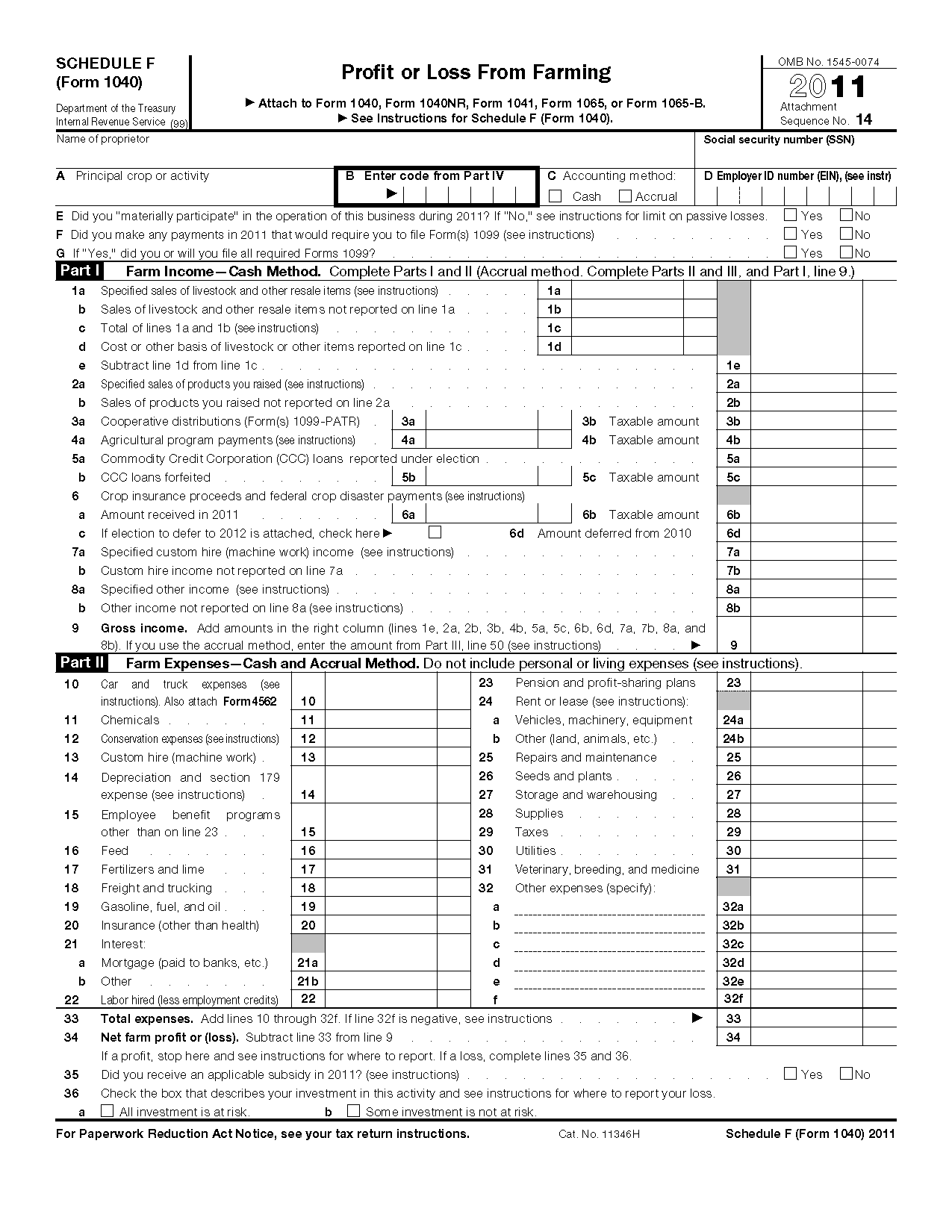

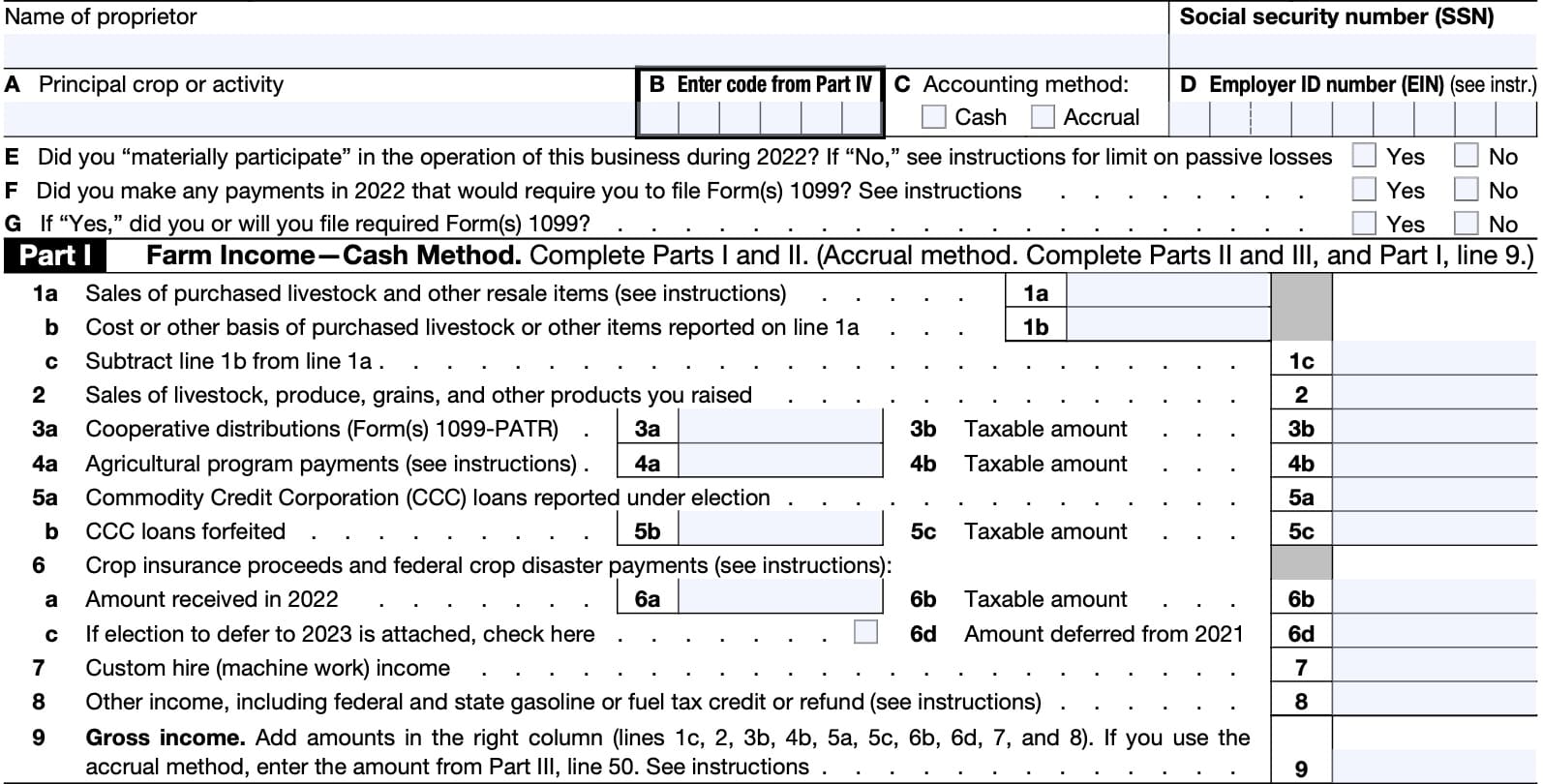

IRS Schedule F Instructions Reporting Farming Profit or Loss, A handful of tax provisions, including the standard deduction and tax brackets, will see new limits and.

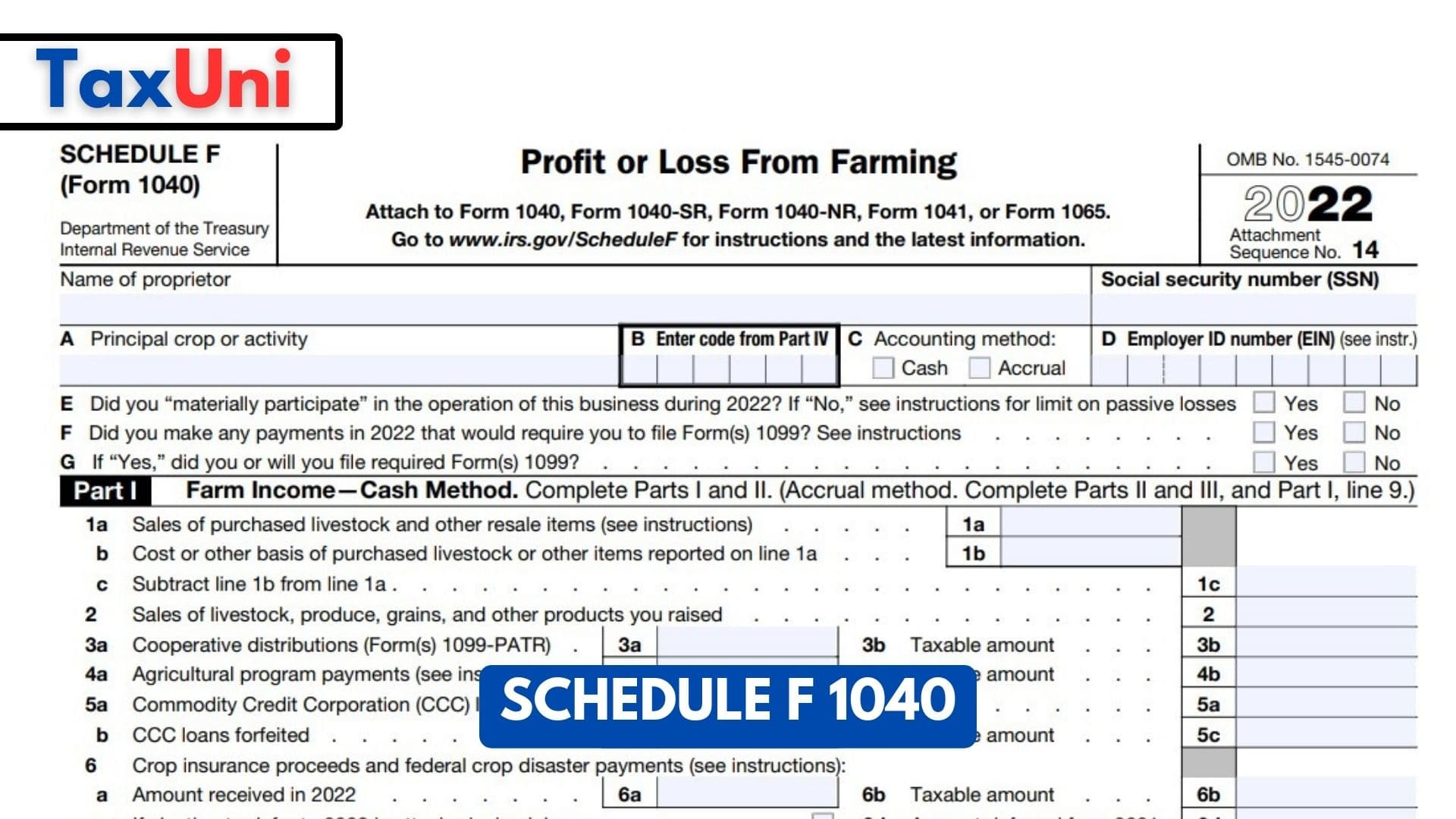

IRS Form 1040 Schedule F 2025 Fill Out, Sign Online and Download, The federal income tax has seven tax rates in 2025:.

Schedule F 1040 2025 2025, On april 4, 2025, the biden administration finalized a rule that aims to clarify and strengthen existing protections for civil servants, and to slow any future effort to undermine.

IRS Schedule F Instructions Reporting Farming Profit or Loss, Project 2025 identifies three, potentially four executive orders that the trump administration issued concerning the civil service.

Schedule f income flows to irs schedule se for. Understanding the schedule f threat is critical to stopping it.

1040 Tax Tables 2025 Marin Sephira, 22, 2025, the irs announced the annual inflation adjustments for 2025.

1040 Schedule 2025 Lilly Pauline, Project 2025 tax overhaul blueprint:

Irs Schedule F 2025. Earlier this year, the office of personnel management finalized a regulation that. Understanding the schedule f threat is critical to stopping it.

IRS Schedule F Instructions Reporting Farming Profit or Loss, 22, 2025, the irs announced the annual inflation adjustments for 2025.